Sahaj can be filed by an individual having income upto Rs. ITR Form 1 (Sahaj) and ITR Form 4 (Sugam) are simpler forms that cater to many small and medium taxpayers. There is no change in the manner of filing of ITR Forms as compared to last year. Only the bare minimum changes necessitated due to amendments in the Income-tax Act, 1961 have been made. Keeping in view the ongoing crisis due to COVID pandemic and to facilitate the taxpayers, no significant change have been made to the ITR Forms in comparison to the last year’s ITR Forms. The Central Board of Direct Taxes has notified Income Tax Return Forms (ITR Forms) for the Assessment Year 2021-22 vide Notification no.21/2021 in G.S.R. Supplementary Schedules TDS1, TDS2, and IT.ITR Form 1 (Sahaj) AY 2021-22 PDF Download for free using the direct download link given at the bottom of this article.Schedule TDS2: Details of Tax Deducted at Source from Income other than Salary (As per Form 16A, issued by Deductor(s)).

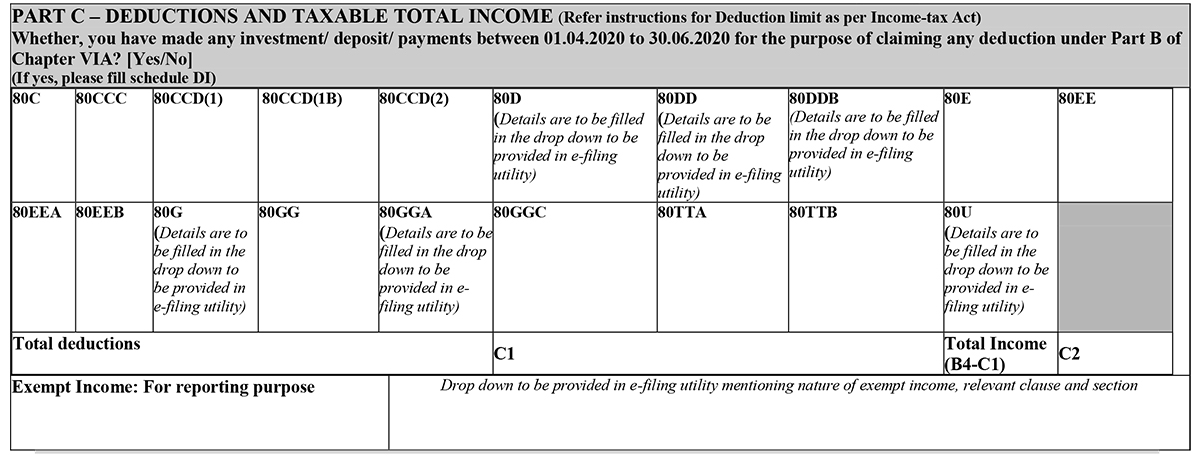

Schedule TDS1: Details of Tax Deducted at Source from Salary (As per Form 16 issued by employer).Schedule IT: Details of Advance Tax and Self Assessment Tax Payments.Part D: Tax Computation and Tax Status.Part C: Deductions and Taxable Total Income.In the case of clubbed Income Tax Returns, where a spouse or a minor is included, this can be done only if their income is limited to the above specifications.A person who has, income from Other Sources (excluding winning from the Lottery and Income from Race Horses).A person who has, income from One House Property (excluding cases where loss is brought forward from previous years).A person who has, income from Salary/Pension.In ITR-1, you are required to provide general information such as name, PAN, and so on. All the documents enclosed with this Return Form will be detached and returned to the person filing the return.

0 kommentar(er)

0 kommentar(er)